Bricks and mortar

Some country kitchens have exposed brickwork and it looks very rustic.

Some country kitchens have exposed brickwork and it looks very rustic.

I don’t think it has quite the same effect here though

Holiday homes vote issue

Second home owners Voting in Cornwall is to be stopped

High levels of second home ownership have led to conflicts in the past over locals trying to make a living and “spoiling the view” – this should come to an end.

The council has made a strict interpretation of the law that means that no one will be able to enrol on their electoral register unless they can prove the county is their main home.

House price changes

Whilst you can use property bee to see how prices change, you can see them in graph format at home.co.uk

You can see despite the tweaking by the estate agent (Often home records the same property info even if it’s taken off and put back on rightmove by the estate agent – something property bee doesn’t do!)

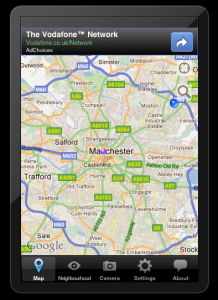

Crime map app for ipad!

You can now use crime maps on the go!

You can now use crime maps on the go!

Download the police maps app!

A really useful app based on the website police crime maps

100% mortgage

100% mortgage is available if you can convince a parent to go guarantor for 25% of it.

That means if you stuff up and don’t keep up the mortgage then your parents will need to pay that 25%.

Recipe for disaster and completely missing the point that people can’t afford to buy whilst house prices are too high for them to save a sensible deposit themselves.

Motorbike in the bedroom?

Is it just me or does a motorbike in the bedroom sound bizarre?

Is it just me or does a motorbike in the bedroom sound bizarre?

New house new locks

When you get the keys to your new house you really should consider changing the locks. You just change the barrels. Some people might think it’s an unneccessary expense but it’s not hugely expensive and will give you instant peace of mind.

If you’ve never done it before then watch some videos or ask for help!

Take the details of the locks (with photos on your phone and measurements of lock height and distance of key hole from edge of door) to a diy shop and ask for assistance in buying new locks.

Locksmiths will do it for you but will cost more!

Stamp duty on expensive properties

Often when a property is very expensive the property is held in a single asset company (this is Stamp Duty saving).

This means that the taxpayer misses out on a windfall of stamp duty from all the expensive properties sold.

Is this fair?

Some stamp duty avoidance schemes are doomed to fail and for less expensive properties take independent legal advice if you are offered a way of not paying it.

You can reduce the amount you pay by sticking under the limits. Up to £125,000 it’s zero percent, and for a limited time it’s zero for first time buyers up to £250k.

There’s an article about single asset property companies here on accounting web

Asking prices and offers

Just reading this morning about two people asking whether to accept offers on their houses.

One was on for £535k and has an offer for £500k. They want to hold out for the extra but seem unaware of the extra stamp duty costs. I do feel the estate agent should have said to them that they shouldn’t expect over 500k because of the stamp duty increase. It increases from 3% to 4%!

Another person was asking about an offer of £300k on a property after 50 viewings over many months on at £335k. Again if it’s the only offer you’ve had and you want to move then you are going to have to consider taking it! Whilst there’s no stamp duty issue on this one it is really something to bear in mind that an offer is better than no offer amd refusing what is a small reduction in asking price is a big risk if you don’t have lots of other offers!

|

Purchase price/lease premium or transfer value |

SDLT rate |

SDLT rate for first-time buyers |

|---|---|---|

|

Up to £150,000 |

Zero |

Zero |

|

Over £150,000 to £250,000 |

1% |

Zero |

|

Over £250,000 to £500,000 |

3% |

3% |

|

Over £500,000 to £1 million |

4% |

4% |

|

Over £1 million |

5% |

5% |