If you watched Location Location Location this week you could be forgiven for thinking we were in the middle of a property boom again.

However we’re not. We’re at risk of entering a recession with growth teetering on the brink of collaspe.

Perhaps LLL has been told not to be negative about the housing market but I feel it gives a really false impression of how things are.

There are concerns that interest rates will rise. Worryingly people already seem to not be able to manage their debt even with the lowest interest rates for hundreds of years. That tells me one thin g – that there is too much debt!

To have a house buying program on TV not try and barter down the prices, or at least explain about how to find bargains in the current market was a suprise.

Maybe there’s a need for a new property program that shows you how to buy a repossession, where to find distressed sellers, and how to bag a real bargain through a normal estate agent.

You could explain how various online tools work. Things like property bee, property snake, and how to find out house prices of properties not listed in the usual places. Sometimes a little imformation would go a long way. Enabling people to know where to find out how much the house last sold for, what the neighbouring houses sold for recently, would enable someone to see the rather cheeky asking prices as something to ignore and offer lower on!

Watch the news when you’re looking at property prices – see how cheery that is. It’ll indicate how long term job prospects are going which is important if you’ve got a mortgage to pay. You should also take note of the up and coming area indicators like chain cafes opening, delis and posh shops. Are there any opening or are they closing? What’s the opposite of an up and coming area? It’s one in decline and it’s perfectly possible all the niceness that happened over the previous boom years could be undone.

As people cut back on their morning £3 cup of coffee perhaps they’ll eventually start thinking about how unaffordable a massive mortgage is too?

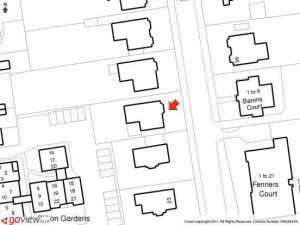

Some estate agent listings make it hard to work out which house is it for sale!

Some estate agent listings make it hard to work out which house is it for sale!