Finding local estate agents

Keep an eye out for ‘For Sale’ signs in your area. Make a note when you see one you don’t recognise so you can get in touch with the agent.

You can use sites like Rightmove or Globrix to look up areas and work out who all the different estate agents are in an area. You should take note though, not all estate agents are on Rightmove all the time. Some never go on it, and some seem to come and go.

Watch out in the local press too for advert pages from local estate agents. Some prefer advertising in the paper. However, I believe all the good ones use Rightmove as it’s such a popular property website.

Sometimes it pays to look at different estate agent websites though as they list the properties there first. It’s also useful to stay in touch with local estate agents so that when something comes up that you’re interested in they’ll get in touch! Make sure that your contact details are up to date and when you’ve bought somewhere, or just stopped looking, you let them know!

Ask people you know which estate agents they have used in the past – this can be quite revealing sometimes and you’ll discover which estate agents have a good reputation locally. Buying a house will mean may have to contact any one of the estate agents – you never know who someone will put their house for sale with. Some you might find troublesome for getting viewings of properties with, persistence is often the key to getting to see houses.

Give estate agents your contact details, plus information on the type of property you want to buy and an idea of your budget. The good estate agents will keep you informed when new properties come on the market.

Emma’s house in Portugal

This is a great website – Emma bought a house and rennovated it in Portugal! Her blog is fascinating, showing not only the work she’s done on her house, but also some of the lifestyle you get when you live in Portugal! For anyone who’s ever wondered what it’d be like to buy and do up a house abroad it’s a great read!

Visit Emma’s House in Portugal Blog

There’s some information about lime in building too which is interesting if you’re interested in exploring old techniques! Well worth bookmarking and enjoying the masses of photos as well as words!

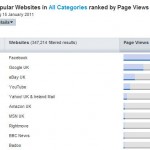

Rightmove one of most popular websites

Rightmove is up there in the top 10 list of most popular websites, based on page impressions in the UK last week, they were the 8th largest website in the UK!

Rightmove is up there in the top 10 list of most popular websites, based on page impressions in the UK last week, they were the 8th largest website in the UK!

(see this on their facebook page)

Rightmove featuring in this list indicates to me that it’s the main house selling and renting website in the UK! So if you’re looking to sell your house you should ensure your estate agent advertises through it!

It also means perhaps that a lot of people spend time browsing it for fun as well as serious house hunting! Whilst it’s not in the same league as Facebook which has 26% of all page impressions, it’s still pretty impressive for any website to be listed there!

Why financial help for FTB hinders

The Isle of Man has asked for extra funds for a scheme that helps first time buyers get a home. It offers financial support.

This is the wrong thing to be doing to help first time buyers. It continues the high house prices that make the houses unaffordable in the first place!

The scheme is asking for £2.8M to help 120 people buy homes.

That means each person is being helped to the tune of £23333.33

Surely if First time buyers need that sort of help then it just means that housing is too expensive!

If FTB are the lifeblood of the housing market then without them prices might fall to affordable levels.

The only people who benefit from this are the house builders who must be laughing all the way to the bank being able to continue to charge more than people can afford.

It’s a shocking scheme in my opinion that should be scrapped. When first time buyers can not afford to buy a house it means they are too expensive!

Whilst this scheme continues the prices will not get more affordable!

Deciding to buy a house

Deciding to buy a house is exciting! The thrill of the chase can start but ou need to get planning if you want to be efficient about it and find the right house for you.

You need to assess your lifestyle and your intended lifestyle when you move, where you want to move to and what budget you have.

What do I mean by lifestyle? It’s how you live your life now. If you spend all your time in the kitchen round the table then is this something you think is essential, or does it reflect that the nicest room in your current house is the kitchen? Do you rent at the moment and house share? Going from a shared house to a rented place probably means having somewhere smaller. Do you love to cook? Do you love to entertain? Do you like open plan spaces or do you like rooms with doors you can separate out each bit of your life? Do you need a couple of bedrooms or just one? Do you have a family who come to stay and will need space? How much stuff is in your garage? What hobbies do you have? Do you need off road parking? Do you want to move to the countryside? Do you want to move to a town? Do you want to move area? Are you moving for work? Do you know the area you want to go to?

There are so many questions to ask your self that it might seem daunting. Jot down a few ideas now to start the ball rolling. You might want a minimum of two bedrooms with parking and a garden. You might want open plan living and a large garden. It’s your chance now to say what it is you want. If you start a house buying diary then you can keep notes on how you’re doing and whether you discover what you want actually changes when you start looking at houses.

If it’s the first house you’ll be buying then you’re best having some help and advice. I’m here if you want someone to help you research or find answers to questions, plus I’m impartial and might be able to offer you some help that your friends might not want to say!

It’s good if you have someone who’s helpful to view houses with. Someone who’ll look past the décor and notice if the rewiring has been done or if the gutters are leaking or the roof needs work. Having someone with a good eye look over the property doesn’t mean you don’t need a survey but it might stop you wasting time and energy on a lemon of a property!

There are so many tools on the internet that can help you when you’re looking for a house to buy that you can do lots of research without even viewing a house! Being prepared for your first viewing is essential and I’ll be writing about that separately to ensure you know exactly what to expect!

Finding locations

Finding your ideal location.

The best way of finding out about an area is to visit it. Some places have very different styles even if they’re only a street or two away from each other. You should explore on foot ideally as it’s easier to be nosey as you’re walking about, rather than risking bumping into something in your car if you’re paying more attention to the houses and neighbourhood than the actual road.

There are some useful tools out there and Rightmove has some great features on its site. You can search by area and if you view the map version you see the boundary drawn out. This is often good for seeing where areas end. You can do this by typing in the name of a village or suburb into the search box.

You can also search by postcode and this is useful if you know the postcode of a particular property on a street. You can then search by increasing the distance from this point in various increments up to 40 miles. Obviously the wider the search the more properties will show up.

One of the most useful features of the Rightmove website is to be able to draw your own search area on a map. First go to the general area you want to narrow down and click on the options for drawing a shape. You can draw by making a series of points which makes it easy for including or excluding roads. You can draw and save many different maps making it easy to have several searches set up. You can also opt for having an email of new properties sent to you every so often. This makes it easy to keep up with the properties coming on the market.

Sometimes you don’t know the postcode of a particular area, but you can track this down using either a general search on the internet or using something like the Royal Mail postcode finder service.

How to spot a repo

Spotting a repo!

If you ever look at photos of a property on Rightmove and notice lots of black and yellow tape over sinks, baths, toilets or even sometimes radiators or boilers, you’ll wonder why. It’s simple. It’s repossession. They get their services turned off so the property isn’t at risk if someone breaks in and robs the radiators for scrap.

Often there will be a notice stuck to one of the front windows or doors which also indicates that it’s a repo.

What does it mean?

It means that the sellers (normally the bank) appoint agents to get the best price for the property that they can. It means you normally have 4 weeks to complete on the property, surveys are limited as gas and water can not be turned on to be checked, and you can be gazumped at any point. They are normally publicised with a public notice in the paper and on websites. If you need a mortgage on a property then that can cause delays. You must be prepared to move quickly on repossession.

The Bank of Mum and Dad

The Bank of mum and dad.

Apparently the age of a first time buyer without help from their parents is 37. That’s pretty shocking and is a damning indictment on the level house prices are at.

If you can’t afford to buy a house on your own what should you do?

You shouldn’t borrow off your parents. That’s one rule I’m very firm on! Whilst people are lending their kids massive deposits it’s just keeping the house prices high! If no one could afford to buy a house then house prices would drop!

If you don’t want to live with your parents all your life then rent! Rent a room in a shared house and it’s cheaper than living on your own. It’s also good life experience to share a kitchen and bathroom!

Why do some parents lend the money? Because they feel perhaps that renting is dead money – but having to borrow a deposit as well as the child having to pay a mortgage stinks of dead wasted money to me!

How will the child pay the parent back? If you can’t afford to save a deposit then how will you pay back this other loan?

People often say they really want to buy a house, but can’t save. When you ask them to do a statement of affairs (SOA) then you see where they spend their money. Often they have quite expensive social lives. It’s that money that needs to be saved and put aside to build up a deposit. If you have no spare money for a social life then you probably shouldn’t be looking at buying a house just yet.

Options are to cut down what you spend; this can involve finding somewhere cheaper to live perhaps, or increasing your income. Sometimes investing effort into your career can pay dividends and increase your income. Some people get second jobs to ensure they have spare money. Another job also solves the problem of having a social life as you run out of time and energy with two jobs!

Borrowing money to get a deposit together is the same as borrowing 100% of a houses value. And we all know where 100% mortgages got people! There’s a survey out there that shows the bigger your deposit the less likely you are to get into arrears with your mortgage. Simply put: if you have saved a deposit yourself then you are more prudent with money and better able to cope with the responsibilities of a mortgage!

Harsh, perhaps but what if you borrowed £50,000 from your parents to buy a new build? New builds drop in value quickly – they stop being new builds as soon as you move in, and you pay for a new build premium too. Your house is worth less than you paid and your parents have a debt you can’t afford to pay back. This strikes me as insanity itself!

Welcome to House Critic

I’ve been writing about houses for many years and have been a member of several forums where I’ve discussed the merits of the housing market, advised people on various aspects of buying houses and enjoyed taking part in the debate about the UK’s obsession with property.

I enjoy watching lots of TV shows about property and hope to review these as time allows. I’ll be giving my thoughts on aspects of the housing market in the UK, and discussing real life examples of houses for sale.